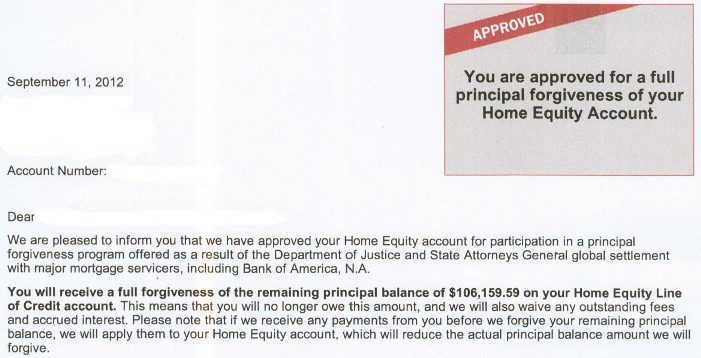

Mortgage loan forgiveness is for real and it is here. How? Back in the spring of 2012, federal banking regulators settled with 14 major mortgage servicers over alleged foreclosure abuses to the tune of $25 Billion. Among the 14, included industry leaders such as Bank of America, JPMorgan Chase, Citibank and Wells Fargo. Now, homeowners are opening letters from these companies and nearly fainting when they read the substance of the letter which describes complete mortgage loan forgiveness. Here's what one of them looks like...

Mortgage loan forgiveness is for real and it is here. How? Back in the spring of 2012, federal banking regulators settled with 14 major mortgage servicers over alleged foreclosure abuses to the tune of $25 Billion. Among the 14, included industry leaders such as Bank of America, JPMorgan Chase, Citibank and Wells Fargo. Now, homeowners are opening letters from these companies and nearly fainting when they read the substance of the letter which describes complete mortgage loan forgiveness. Here's what one of them looks like...

That came from a short sale deal I am working on right now. Typically, with second mortgage HELOCs, even though the bank may accept a huge discount because the loan is in the second position, since it is a Home Equity Line of Credit, the bank usually holds the borrower responsible for the difference. In this case, the homeowners were contemplating filing bankruptcy after the short sale was complete in order to wipe out whatever deficiency was left from the short sale. And then, like manna from heaven, that little letter showed up. They couldn't believe it. I couldn't believe it! But it is for real and it is going to be happening a whole lot more in the coming months. Here is the official statement from BoA, "Bank of America Notifies Eligible Mortgage Customers of Second Lien Mortgage Debt Extinguishment."

What does all this mean to you? If you're a homeowner with a second mortgage with one of the major mortgage servicing companies, you may want to call your bank to see if your loan is eligible for mortgage loan forgiveness. If you're an investor, get some short sales going on deals that have second mortgages with the likes of Bank of America, Chase, Wells Fargo or CitiBank. You may can get ahead of one of these letters. But make sure you are using a contract that can handle mortgage loan forgiveness because if not, you may not benefit from it. And finally, if you're a hard working American who has always paid your mortgage on time and has always maintained equity in your home, even during the housing collapse, you can complain to the powers that be that responsible people like yourself are getting the raw end of this mortgage loan forgiveness deal.

Looking for direction on receiving partial debt forgiveness for a WAMU heloc that is now held by Chase